Prenuptial agreements get a bad rap. Many people are reluctant to broach the subject with their intended spouse because of the stigma. Wanting to protect yourself and your assets or shield yourself from your soon-to-be spouse’s debt doesn’t mean that you don’t believe your marriage will last. Think of prenuptial agreements like insurance. You purchase homeowner’s insurance for protection, but you don’t anticipate your house burning down.

Do you need to learn more about a customized asset protection agreement before you say “I do”?

At The McKinney Law Group, we provide experienced insight into Florida prenuptial laws and personalized legal advice so you can decide if a prenuptial agreement is right for you and your fiancé. We get to know your goals and priorities and show you how a prenup can help you. Contact us today to speak with our Florida prenup lawyer.

Customized Protections From Our Florida Prenup Attorney

We start by getting to know you, your current financial state, and your goals. This allows us to demonstrate how a prenuptial agreement can benefit you. We customize the agreement to meet your needs and can include as many or as few protections as you wish.

The goal of a prenuptial agreement is to make a divorce as least contentious as possible, at least when it comes to dividing assets and assigning debts. You may have certain obligations financially, that a prenuptial agreement can protect.

For example, we often work with couples on a second or third marriage who each have financial responsibilities to children form other relationships or spousal support obligations. A prenuptial agreement may simply be the best way to preserve each spouse’s respective responsibilities. In some cases, post-nuptial or pre-nuptial cases may serve as a map for dividing financial obligations, dividing assets, providing spousal support, and paying debts in cases where the couple separates before the divorce.

Keeping You Involved And Providing Answers

The goal of our Florida prenup lawyer is to make sure that you’re properly informed about legal options to protect your rights and assets while avoiding certain conflicts in your marriage. Whether you opt for a prenup, postnup, or neither, we want to make sure that you have the best information to make the right decisions for your family.

We also review any pre-or post-nuptial agreement you are presented with on your behalf. You have the right to have your own lawyer read over a pre-up and determine if it’s fair to you. We’re here to negotiate a more equitable agreement to represent your interests and goals and make sure that, if the unthinkable happens, you’re protected and have the wherewithal to move forward after the marriage dissolution.

Understanding Prenup Law And Determining The Wealth Threshold For Consideration

Our Florida prenup attorney has witnessed the significant attention that prenuptial agreements have garnered in recent years. These legal contracts, established before marriage, outline the division of assets and financial responsibilities in the event of a divorce. While historically associated with the wealthy, prenups have become increasingly relevant to a broader demographic. At The McKinney Law Group, we believe that understanding the essentials of prenup law and the circumstances under which one should consider a prenup is crucial for protecting your financial future.

Explaining Prenuptial Agreements

A prenuptial agreement is a legal document created by two individuals before they marry, detailing the management and division of their assets in case the marriage ends. This agreement can cover various aspects, including property division, spousal support, and the handling of debts. By setting these terms in advance, couples can avoid potential conflicts and ensure that both parties’ financial interests are protected.

Benefits Of Having A Prenup

The primary benefit of a prenup is the clarity and security it provides. Couples can explicitly state how they want their assets divided, which can prevent lengthy and costly legal battles in the future. A prenup can also protect individual assets acquired before the marriage, ensuring that family heirlooms, business interests, or investments remain with their original owner. Additionally, it can define spousal support terms, offering financial predictability for both parties.

When You Should Consider A Prenup

There are various factors such as financial status, family circumstances, and personal preferences that will come into play when determining whether to establish a prenuptial agreement. While there is no one-size-fits-all answer, several scenarios typically warrant considering a prenup.

Significant Assets Or Income

If either partner has substantial assets or a high income, a prenup can safeguard these assets. This protection is particularly important in states like Florida, where equitable distribution laws could result in a considerable portion of one’s assets being awarded to the other spouse in a divorce. As Florida prenup lawyers, we often advise clients with significant wealth to consider a prenup to maintain control over their financial future.

Ownership Of A Business

Business owners should strongly consider a prenup to protect their enterprise. A prenup can stipulate that the business remains with its original owner, preventing a situation where the business might need to be sold or divided in the event of a divorce. This protection makes sure that the business can continue operating smoothly without the threat of financial disruption.

Previous Marriages And Children

Individuals entering a second or subsequent marriage, especially those with children from prior relationships, should consider a prenup. This agreement can help make sure that assets are distributed according to one’s wishes, protecting the inheritance rights of children and other family members.

Debt Protection

If one partner has significant debts, a prenup can protect the other partner from assuming liability for those debts. This protection is vital in maintaining financial stability and preventing one spouse’s financial issues from impacting the other’s credit and financial health.

How Much Wealth Is Necessary To Consider A Prenup

While there is no specific wealth threshold for considering a prenuptial agreement, certain financial situations often warrant serious consideration. Generally, if you have assets or income that you wish to protect, a prenup is a wise investment.

Couples with assets exceeding $50,000 should consider discussing a prenup. This amount may include cash savings, property, investments, or retirement accounts. However, the necessity for a prenup isn’t strictly tied to a monetary value. Factors such as potential future earnings, business interests, and family heirlooms also play significant roles.

For couples with a net worth of $100,000 or more, a prenup becomes even more advisable. As wealth increases, so does the complexity of asset management and division, making the clear terms set by a prenup even more valuable.

Advantages of Hiring an Attorney

Working with our experienced lawyer is essential to making sure that the agreement is legally sound and tailored to your specific needs. Our family law team offers a skilled and compassionate approach when facing matters of this nature, and understands the elements of Florida prenuptial law and are dedicated to helping our clients create comprehensive agreements that protect their interests.

Financial Protection Through Prenups

For anyone looking to protect their financial future and avoid potential conflicts, it’s important to consider a prenuptial agreement, a legal contract that can act as a practical tool. If you have significant assets, own a business, have children from previous relationships, or are concerned about debt, a prenup is worth considering. We encourage you to reach out to Mr. McKinney, a seasoned lawyer with more than 18 years of experience who will offer personalized advice and support. Contact The McKinney Law Group today to schedule a consultation with our Florida prenup lawyer and take the first step toward safeguarding your financial future.

Schedule A Personalized Consultation With A Florida Prenup Lawyer

If you’re engaged, thinking about marriage, or already married but worried about your assets or debt obligations, we’re ready to help. The McKinney Law Group represents people who are considering marriage and those who are already married, drafting prenups or post-nups to protect your interests. We can help you preserve your relationship and protect what you’ve worked so hard for. Contact us today for a consultation with our Florida prenup lawyers.

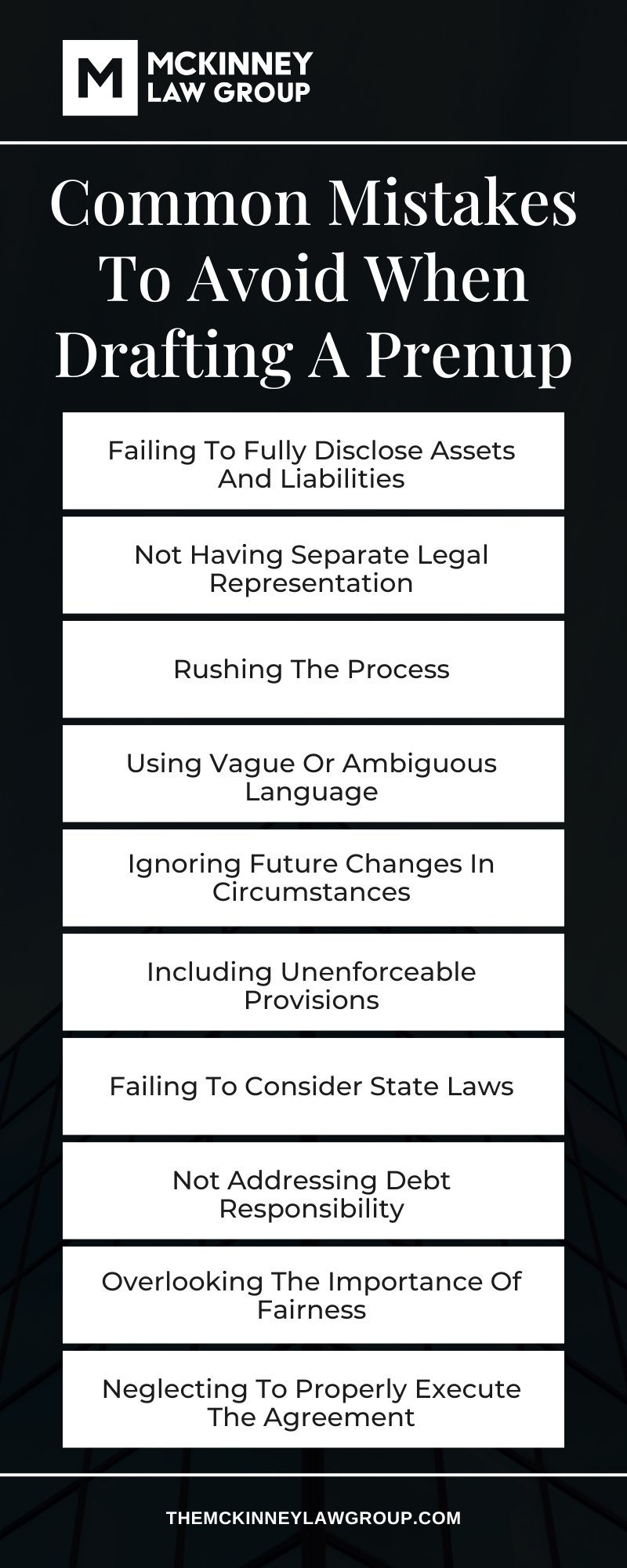

Common Mistakes To Avoid When Drafting A Prenup

For many couples who intend to marry, creating a prenuptial agreement is a wise step. It provides a clear understanding of financial expectations and responsibilities, making sure that both parties are on the same page as they enter marriage. However, drafting a prenup involves careful consideration and legal know-how. Avoiding common pitfalls can save you from future disputes and make sure that the document holds up in court. Our family lawyer will share some mistakes to steer clear of when drafting a prenuptial agreement.

1. Failing To Fully Disclose Assets And Liabilities

One of the biggest mistakes is not being completely transparent about your financial situation. Both parties must disclose all assets and liabilities fully. Incomplete disclosure can lead to the prenup being declared invalid. Honesty is vital in these agreements, and it sets a tone of trust for the marriage.

2. Not Having Separate Legal Representation

Each party should have their own legal representation to make sure that their interests are fully protected. Sharing an attorney can lead to a conflict of interest and may cause the prenup to be challenged later. Independent legal counsel for both partners makes sure that the agreement is fair and voluntarily signed.

3. Rushing The Process

Drafting a prenup is not something to do at the last minute. Rushing through the prenuptial process can lead to oversights and mistakes. Take the time to discuss and draft the agreement well before the wedding date. This provides both parties with ample time to consider the terms and seek appropriate legal advice.

4. Using Vague Or Ambiguous Language

Clear and specific language is critical when drafting a prenup. Vague or ambiguous terms can lead to misinterpretations and disputes down the line. It’s important to be precise about what each clause means and how it will be applied. Our family law attorney can help verify that the language is legally sound and unambiguous.

5. Ignoring Future Changes In Circumstances

A prenup should consider potential changes in circumstances, such as career changes, the birth of children, or significant financial shifts. Including clauses that address these possibilities can prevent disputes in the future. It’s wise to review and update the prenup periodically to reflect any major life changes.

6. Including Unenforceable Provisions

Certain provisions, like those related to child custody or support, may not be enforceable in court. Including such terms can render parts of the prenup invalid. Focus on enforceable aspects like property division and spousal support. Our family law attorney can guide you on what can and cannot be included.

7. Failing To Consider State Laws

Prenuptial agreements are subject to state laws, which can vary significantly. What is enforceable in one state may not be in another. Confirm your prenup complies with Florida laws to avoid complications. Consulting our knowledgeable attorney familiar with state-specific requirements is essential.

8. Not Addressing Debt Responsibility

It’s essential to outline how debts will be handled in the prenup. Failing to do so can lead to disputes over who is responsible for premarital and marital debts. Clearly specifying debt responsibility can prevent future conflicts and provide financial clarity.

9. Overlooking The Importance Of Fairness

A prenup that heavily favors one party over the other can be seen as unfair and may not hold up in court. Verifying the agreement is fair and equitable to both parties increases its enforceability. Both partners should feel the terms are reasonable and just.

10. Neglecting To Properly Execute The Agreement

The execution of a prenup must follow specific legal formalities. This includes signing the document in the presence of witnesses and ensuring it is properly notarized. Failing to adhere to these formalities can lead to the agreement being invalidated. Our legal professional can confirm all legal requirements are met during execution.

Drafting A Strong And Enforceable Prenup

Careful planning and skilled legal support is essential when drafting a prenuptial agreement. Avoiding these common mistakes can help create a robust and enforceable document that protects both parties. At The McKinney Law Group, we have extensive experience in practicing divorce law, family law, alimony law and more, and we understand the importance of getting it right the first time. If you’re considering a prenup, our experienced Florida prenup lawyers are here to guide you through the process. Contact us today to schedule a complimentary consultation and ensure your prenuptial agreement is tailored to your needs and compliant with state laws.

Florida Prenup Infographic

Florida Prenup Statistics

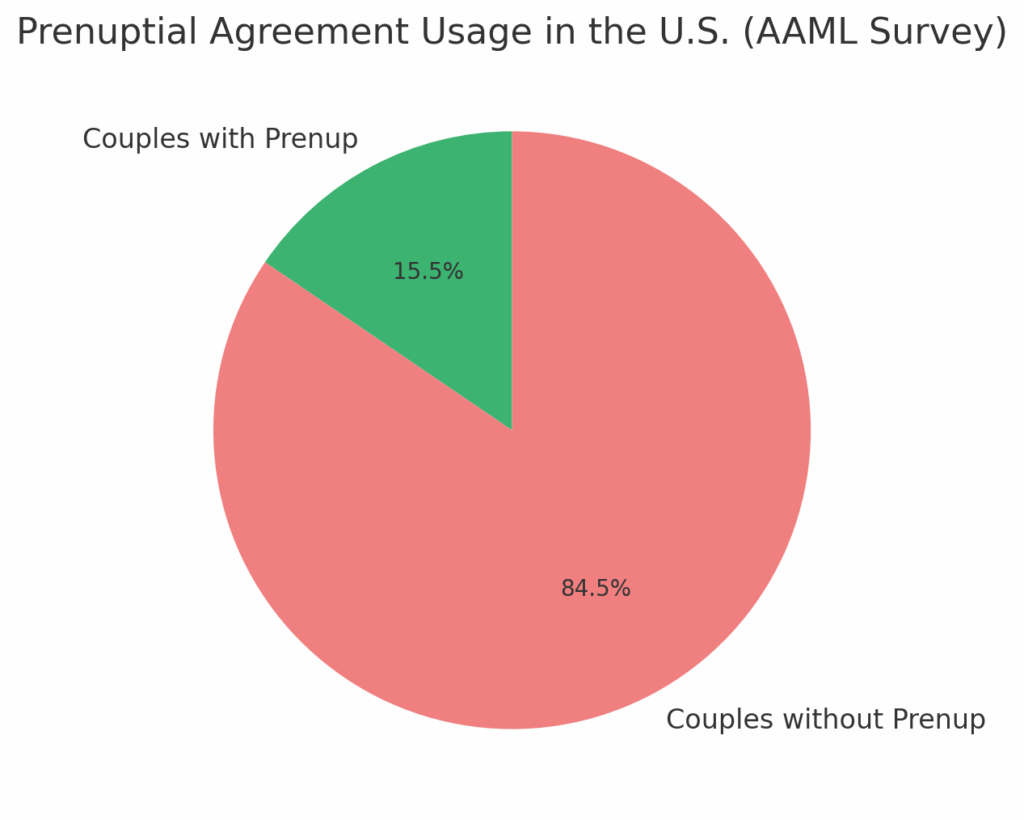

Prenuptial agreements, commonly known as prenups, are legal contracts signed before marriage to outline the division of assets, debts, and financial responsibilities in the event of divorce or death. Despite their potential benefits, prenups are not widely utilized in the United States. According to a survey by the American Academy of Matrimonial Lawyers (AAML), only about 14–17% of couples entering marriage have a prenuptial agreement. However, interest in these agreements is increasing, particularly among older adults, high-net-worth individuals, and those entering second marriages.

The use of prenups is more common among couples with substantial assets, business interests, or children from previous relationships, as these agreements provide clarity and protect financial interests. Additionally, prenups can address spousal support, inheritance rights, and debt responsibility, reducing the likelihood of contentious legal disputes in the event of divorce. Studies show that couples who discuss prenups before marriage often report greater financial transparency and fewer conflicts regarding money.

Prenup FAQs

Considering the financial implications of a potential divorce is not always something couples consider when they are getting married. While discussing a prenuptial agreement might seem unnecessary at the time, there can be significant repercussions for not having one in place. Our Florida prenuptial agreement lawyer can help couples understand how a prenup could protect their financial interests before entering into marriage. Here, we address some of the common questions regarding the consequences of not having a prenuptial agreement.

What Happens If We Don’t Have A Prenuptial Agreement?

If there is no prenuptial agreement in place, the division of assets and debts is left to state law in the event of a divorce. Courts will typically follow Florida’s equitable distribution laws, meaning assets and debts will be divided in a way that the court deems fair, but this doesn’t always mean a 50/50 split. Without a prenup, couples have less control over how their financial situation is handled if the marriage ends.

Can Not Having A Prenup Affect Property Division In A Divorce?

Yes, not having a prenuptial agreement can significantly affect how property is divided in a divorce. Courts will divide marital property based on equitable distribution laws, which can lead to an outcome neither party anticipated. A prenup allows couples to outline how property should be divided before any issues arise, giving them more say in the process. Without it, property division is left entirely up to the court’s discretion, which may result in an outcome that feels unfair.

How Are Debts Divided Without A Prenup?

Debts incurred during the marriage are treated similarly to marital assets in the absence of a prenuptial agreement. Courts will divide marital debts in a fair manner, which may not necessarily mean an equal division. If one spouse acquired significant debt, both spouses could be responsible for repaying it. Without our lawyer helping to outline debt division ahead of time, there is little control over how debts will be assigned in a divorce.

Will I Lose My Inheritance If There Is No Prenup?

Generally, inheritances are considered separate property, meaning they are not subject to division during a divorce. However, this can become complicated if the inheritance was commingled with marital funds, such as by being deposited into a joint account. In this case, the court may consider it marital property, meaning it could be divided. A prenup helps protect inheritances by clearly outlining what is considered separate property.

Can My Spouse Claim My Business Assets Without A Prenup?

Yes, without a prenuptial agreement, business assets acquired during the marriage may be subject to division in a divorce. Even if one spouse owned the business before the marriage, any increase in the business’s value during the marriage could be considered marital property. A prenup can protect business interests by clearly stating how the business and its growth should be handled in the event of a divorce.

Prenup Law Glossary

When planning a marriage, having informed legal guidance is just as important as planning the ceremony. Our Florida prenuptial lawyer plays a key role in helping couples understand how legal tools like prenuptial agreements can support financial clarity and long-term planning. Below are five important legal terms and phrases commonly associated with prenuptial agreements in Florida. These definitions are intended to clarify what these concepts mean in practice and how they apply during the drafting and execution of a prenup.

Equitable Distribution

Equitable distribution refers to the legal process Florida courts use to divide marital property during a divorce. This doesn’t mean everything is split 50/50, but rather what the court considers fair based on various factors. Without a prenuptial agreement, couples may have limited control over how property is divided. Including detailed terms in a prenup allows both spouses to agree in advance on how their property—such as homes, bank accounts, or retirement savings—should be handled, regardless of what a court might later decide.

Separate Property

Separate property is any asset or debt that a spouse owned prior to the marriage or acquired individually during the marriage through inheritance or as a gift. A properly drafted prenuptial agreement can clearly identify which items will remain separate, protecting them from being treated as shared marital property. If these assets are not specified, there’s a risk they may become mixed with marital property during the marriage and lose their separate status. Documenting separate property is especially important for individuals who own significant real estate, investment accounts, or family heirlooms.

Business Interest Protection

This clause refers to a section of a prenuptial agreement that safeguards ownership of a business, particularly for entrepreneurs and professionals who built their companies before marriage. Without these protections, the growth or appreciation of a business during the marriage may be considered marital property. A business interest provision can clarify that the business remains solely with its original owner, regardless of its future value. It can also define how profits, management rights, or debts related to the business are treated during and after the marriage.

Spousal Support Provisions

Spousal support, also called alimony, is financial support that one spouse may be required to pay to the other after a divorce. Including specific spousal support terms in a prenuptial agreement allows both partners to define the scope and limits of future financial obligations. This may include waiving alimony entirely, setting a fixed amount, or establishing time-based payments. While Florida courts retain discretion in certain cases, a well-drafted prenup with clear spousal support terms is generally enforceable, provided both parties had independent legal counsel.

Debt Allocation Clause

Debt allocation refers to the division of financial obligations in a prenuptial agreement. These provisions help protect each spouse from being responsible for the other’s premarital or future debt. This is especially important if one partner has significant student loans, credit card balances, or personal loans. A prenuptial agreement can identify which debts are individual and which, if any, are shared. This helps avoid surprises in the event of a divorce and can protect credit scores and financial independence.

Every couple brings their own financial picture to the table. Whether you’re coming into a marriage with savings, a business, or responsibilities from a prior relationship, clearly defining your financial intentions through a legally enforceable agreement is a valuable step. At The McKinney Law Group, we draft prenuptial agreements that reflect your goals and provide legal clarity that supports long-term peace of mind.

If you’re planning to marry or are already married and want to create a post-nuptial agreement, we can help you take the next step. Contact us to schedule a confidential consultation with our family lawyer.

When To Consider A Prenup For Financial Protection

To make sure that both parties are on the same page when it comes to finances, it may be a good idea to discuss a prenup early on in the relationship. If you have any questions about how a prenuptial or postnuptial agreement can protect your financial future, our team at The McKinney Law Group is here to assist, we have over two decades of experience. Contact us today to speak with our Florida prenup lawyer and take control of your financial future. We offer complimentary consultations and have over 18 years of experience.